OTHER NAMES

General Repayment Plan

Deferral Agreement

Temporary Reduced Payment Agreement

Deferred Payment Plan

What is a Payment Plan?

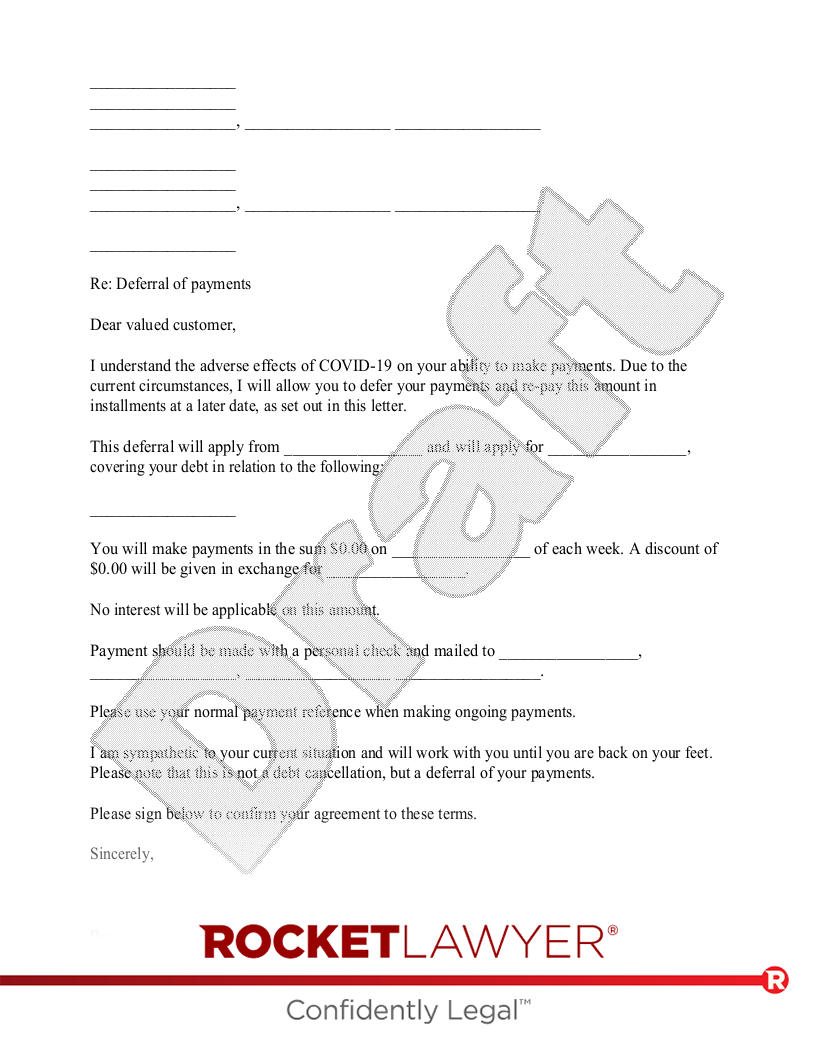

Creating a Payment Plan can help both parties avoid conflict by outlining clear rules for the repayment of deferred debt. This agreement will detail when the deferral period starts, the duration of the deferral period, the installment amount, and when installments are to be paid. The agreement also allows you to offer a discount on deferred debt in exchange for the performance of specialized services or repairs.

While this document is intended to support those who have been unexpectedly laid off or furloughed, you should only enter into this agreement if you believe the other party will make a good faith effort to repay the debt.

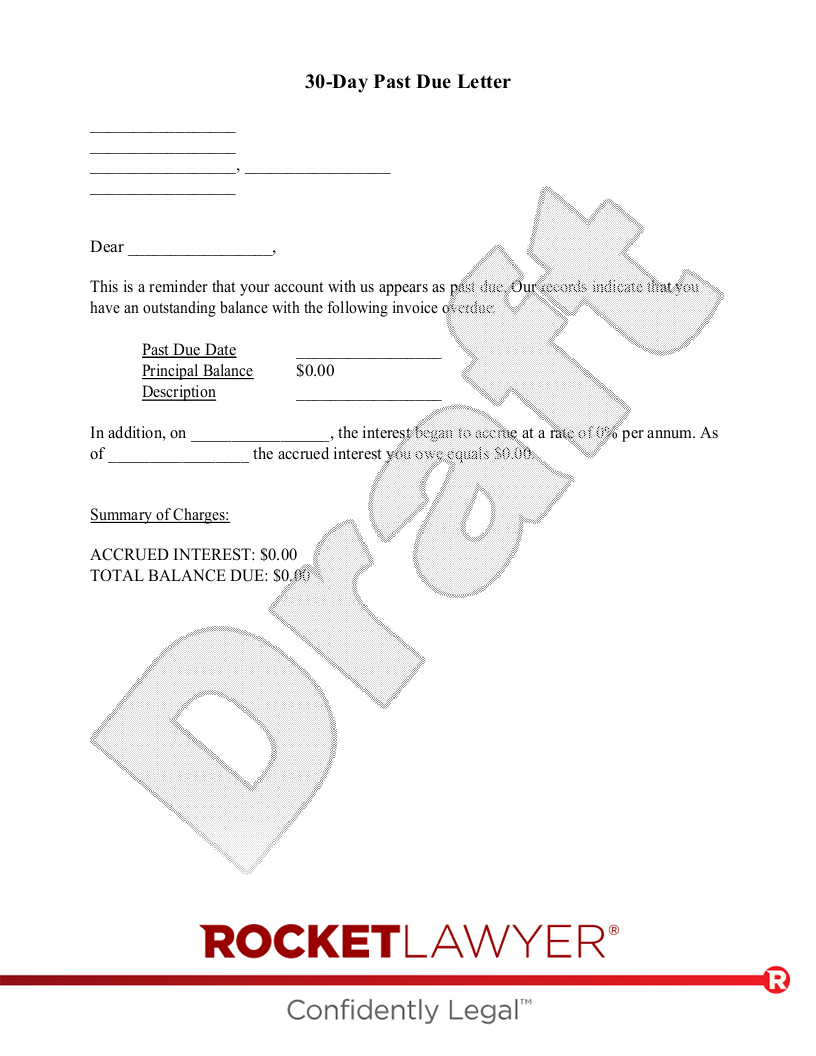

When to use a Payment Plan:

- You are a creditor whose debtor can't pay on time.

- You have been asked by your debtor to defer payments.

- You want to set out the terms of the debt repayment.

- You want to offer a discount in exchange for specific services.