OTHER NAMES

Business Structure and Entity Planning Worksheet

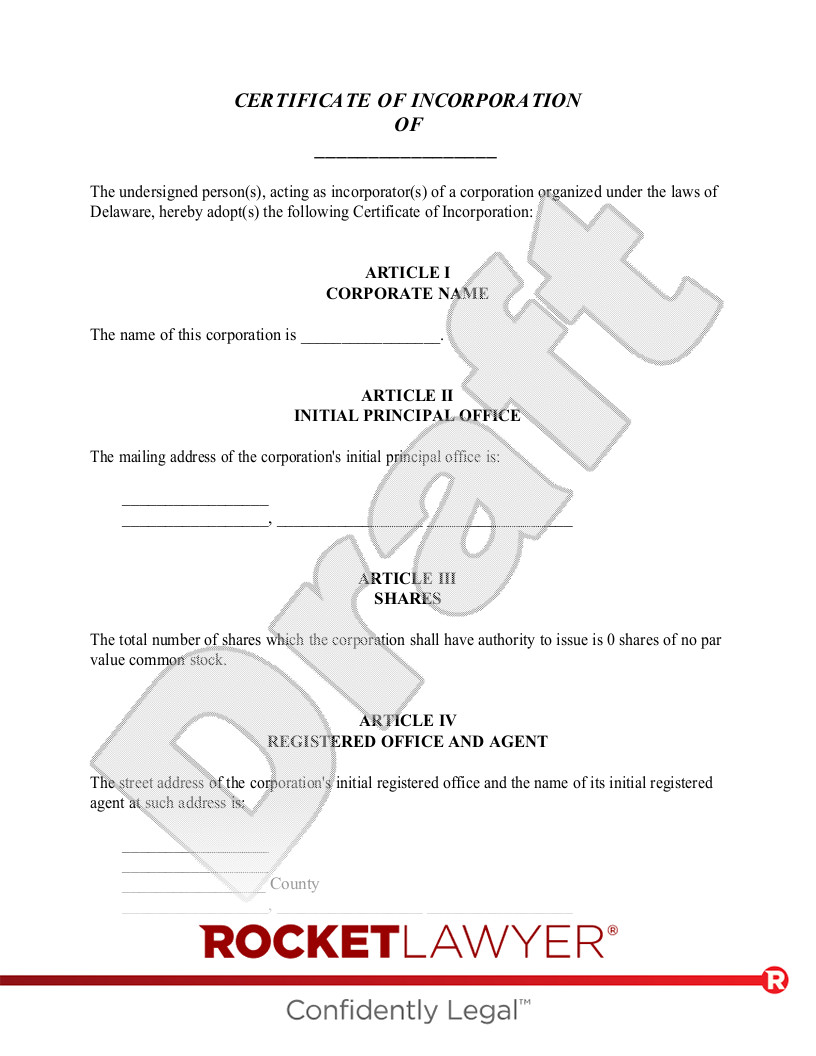

Business Entity Planning

What is a Business Entity Planning Worksheet?

Making the right decision about your business entity sets you up for success. Use the Business Entity Planning Worksheet to compile all the necessary information, whether you're starting a new new business entity, or changing an existing one. Need to provide some information to an attorney or tax professional so they can help? The Business Entity Planning Worksheet is a great start.

If you're seeking to establish a sole proprietorship, partnership (general), limited partnership, "C" corporation (regular), "S" corporation, or limited liability company, the Business Entity Planning Worksheet will help you list the most important details, particularly with relation to liability and income tax considerations. You can include information about the business property, where the business will operate, management structure and employees, and employee benefits. You can also determine what liabilities your business entity may have, and what will be done with the business' income.

When to use a Business Entity Planning Worksheet:

- You are considering forming a new business, or changing the structure of an existing business.

- You need to identify basic information needed to form a new business.

- You want to prepare the information to be provided to a lawyer, accountant, or other tax expert for their assistance in determining the appropriate type of organization for a new business.

- You want to review the characteristics of various forms of business structures.