OTHER NAMES

Bank Fraud Dispute Letter

Letter to Challenge a Transaction

Dispute Letter for a Fraudulent Transaction

What is a Letter to Dispute a Fraudulent Bank Transaction?

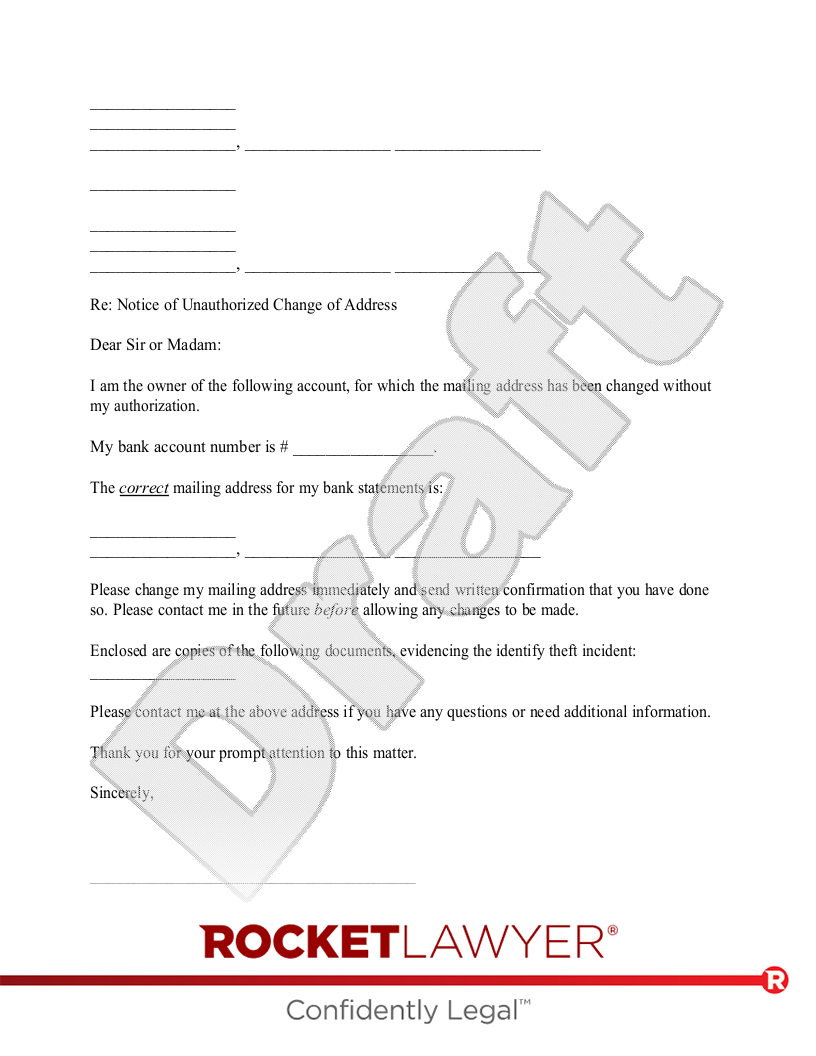

If you have an unauthorized charge in your checking or savings account, you can file a Dispute Fraudulent Bank Transaction document, which will help you get that money back. Maybe your debit card was stolen. Or maybe someone got ahold of your checkbook and went on a shopping spree. A Letter to Dispute a Fraudulent Bank Transaction helps right financial wrongs.

A Fraudulent Bank Transaction Dispute Letter lets the bank know that there is unauthorized activity on your account, and that you shouldn't be liable for those charges. You typically must report such errors within 60 days after the closing date on the bank statement. (There could details on your statement that explain the procedure you should follow, so it pays to read it carefully.) With this document, you can help make sure no additional unauthorized charges are made, while ensuring your paperwork is in order. A Letter to Dispute a Fraudulent Bank Transaction helps you establish a paper trail when it comes to communicating with your bank.

When to use a Letter to Dispute a Fraudulent Bank Transaction:

- There are unauthorized charges in your checking or savings account.

- You want to challenge transactions in your accounts.

- You've called your bank to dispute the charges, but want to follow up in writing.