OTHER NAMES

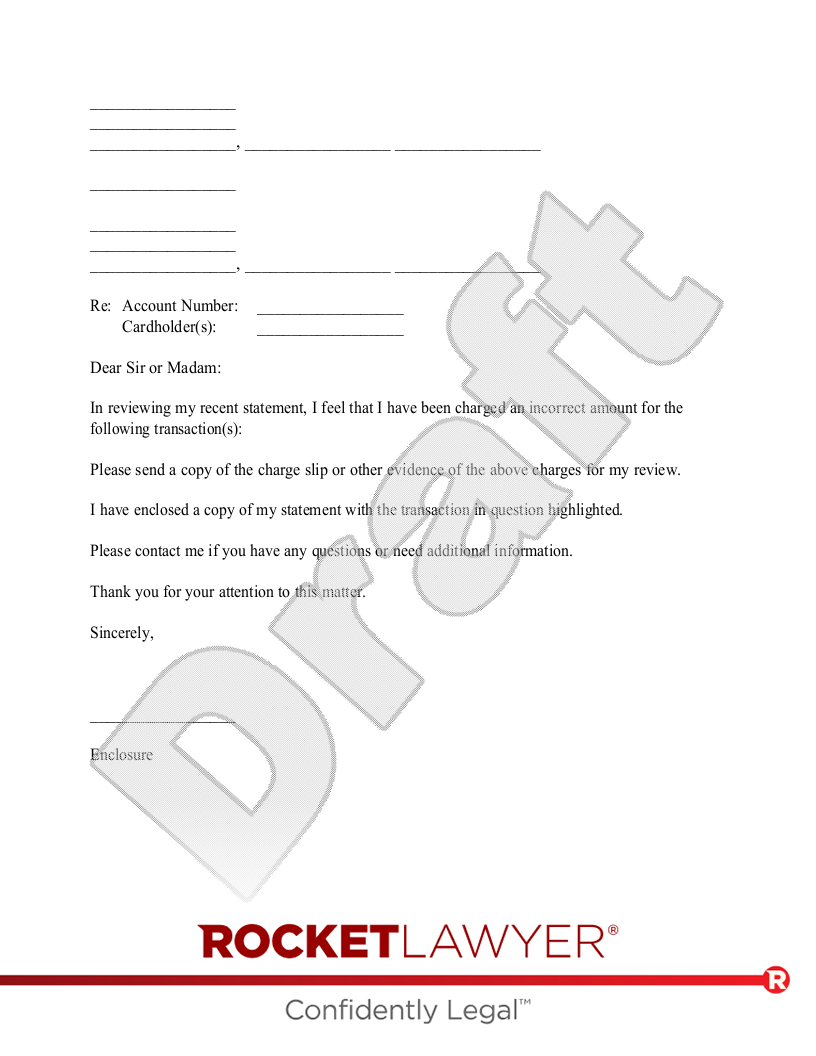

Letter to Dispute Credit Card Charges

Challenge Letter for Credit Card Fraud

What is a Letter to Dispute a Fraudulent Credit Card Transaction?

If you suspect you are the victim of credit card fraud, you can use a Letter to Dispute a Fraudulent Credit Card Transaction to help fix things. With this easy-to-use document, you can contact your credit card issuer and clear up the problem, and keep a record of your communication. Filing a Letter to Dispute a Fraudulent Credit Card Transaction can help put a stop to the fraud, and protect your credit score.

The Fair Credit Billing Act allows credit card users to contact their credit card company within 60 days of receiving the credit card statement with the unauthorized activity. The Letter to Dispute a Fraudulent Credit Card Transaction is thus an important tool in alerting your credit card company to potential fraudulent activity. Help protect yourself with this document.

When to use a Letter to Dispute a Fraudulent Credit Card Transaction:

- You want to dispute unauthorized credit card charges.

- You've already spoken to your credit card company, but want to leave a paper trail of the dispute.