OTHER NAMES

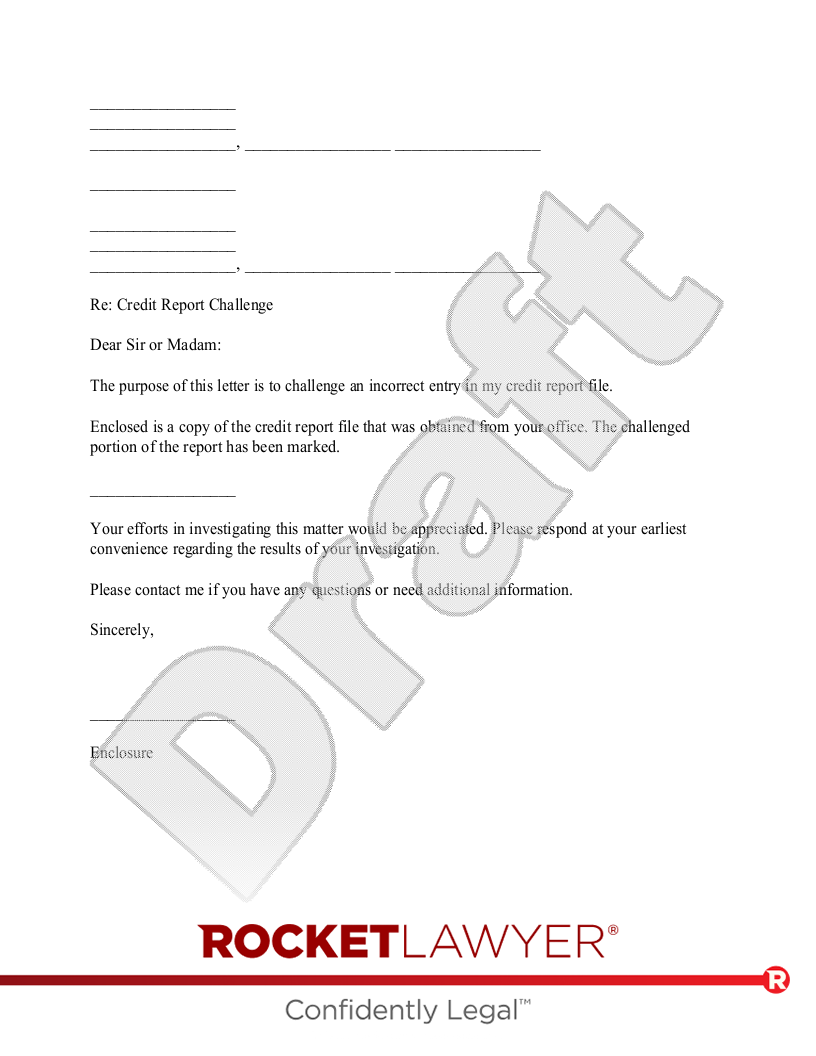

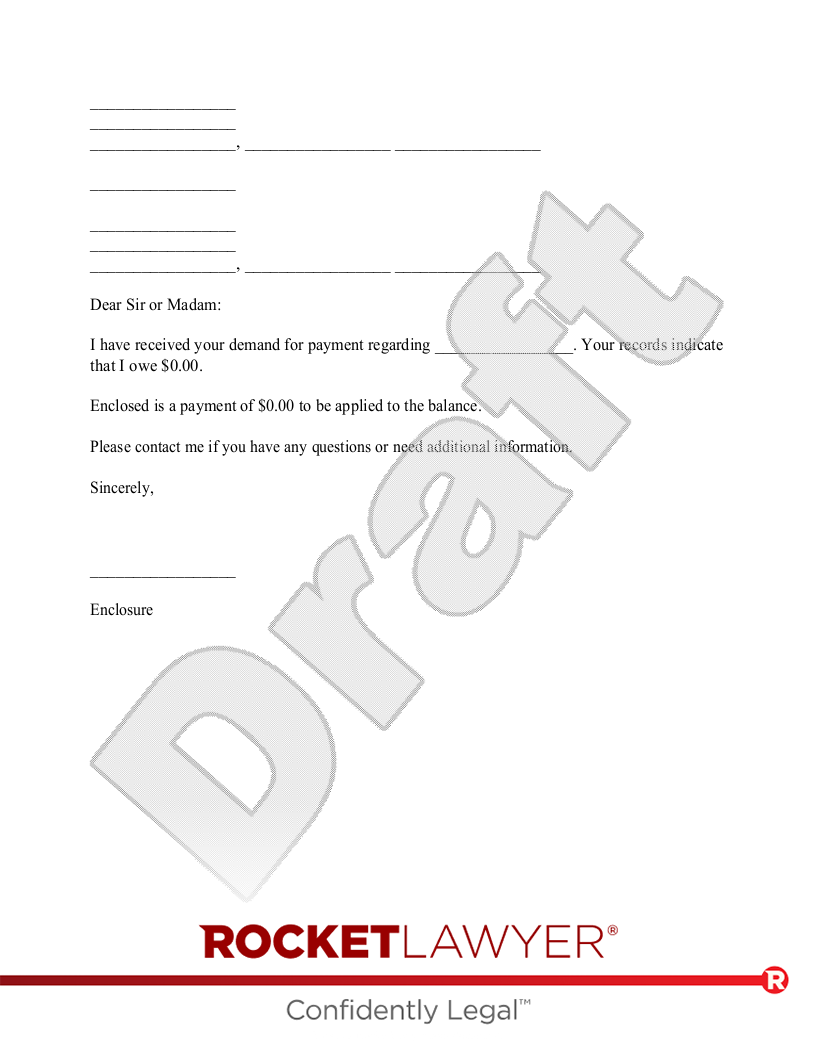

Credit Report Challenge Letter

Challenge Credit Report

What is a Credit Report Challenge?

If you need to challenge something on your credit report, you can use a Credit Report Challenge. As your credit score is crucial when a creditor is deciding if you're loan-worthy, you can use a Credit Report Challenge to help ensure that your score remains accurate.

A Credit Report Challenge can be used when you discover an error on your report. For example, perhaps you paid off that old video rental account years ago, and one of the credit reporting bureaus is still reporting it as overdue. You can use this document to provide as much information about your specific situation as you can. The credit bureau is then required to investigate your case (at no charge), and must correct any mistakes or remove any information that it can't verify.

There are three separate credit reporting bureaus, and you have to make sure your information is correct on all of them. If you encounter a mistake you can use a Credit Report Challenge to help correct it.

When to use a Credit Report Challenge:

- You want to challenge something on your credit report.

- You'd like to add an explanation to an item on your report.

- You want to request the deletion of information more than seven years old (ten years in the case of bankruptcy).