OTHER NAMES

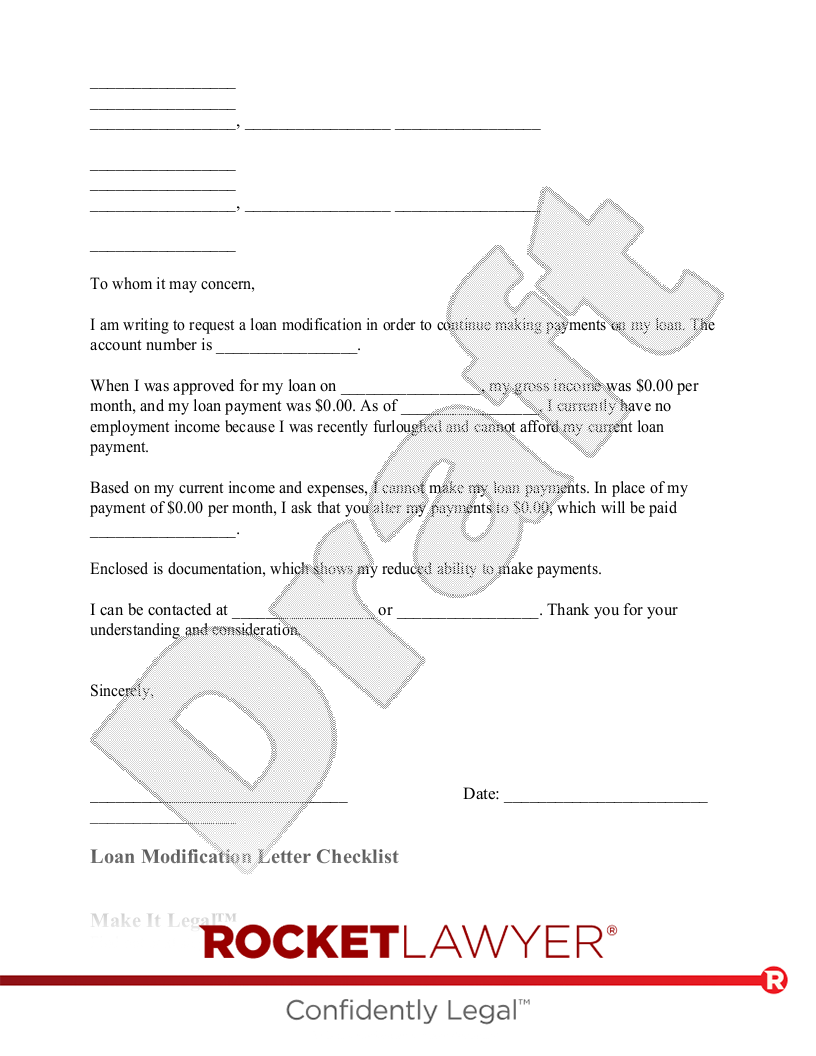

Loan Modification Request Letter

What is a Loan Modification Letter?

A Loan Modification Letter is written to your mortgage or loan provider to request a permanent change in your loan payments. A typical Loan Modification Letter outlines your situation before the financial hardship occurred, and then describes your current financial situation and why you are unable to adhere to your original loan terms. Some common reasons for writing a Loan Modification Letter include injury, loss of job, economic downturn, an illness to you or a family member, etc.

Making a Loan Modification Letter allows you to seek relief from your lenders when your financial situation changes. Unlike a forbearance, which is typically temporary, a loan modification permanently alters your loan payment plan and is a long-term solution if you do not think your financial situation will improve. A Loan Modification Letter can be used for business or personal loans.

When to use a Loan Modification Letter:

- You have suffered a loss of income and want to amend your loan payment.

- You recently lost your job and cannot continue making your current monthly loan payments.

- Your business has experienced a loss in revenue and you need to request relief.

- You have exhausted all other financial resources and need new loan terms.