Make your Free Dissolution of Partnership Deed

Follow proper process when you and one or more other individuals carrying on a business in partnership have agreed to bring the partnership to an end with this dissolution of partnership deed. This... ... Read more

How to Make a Dissolution of Partnership Deed

-

Summary of dissolution of partnership deed

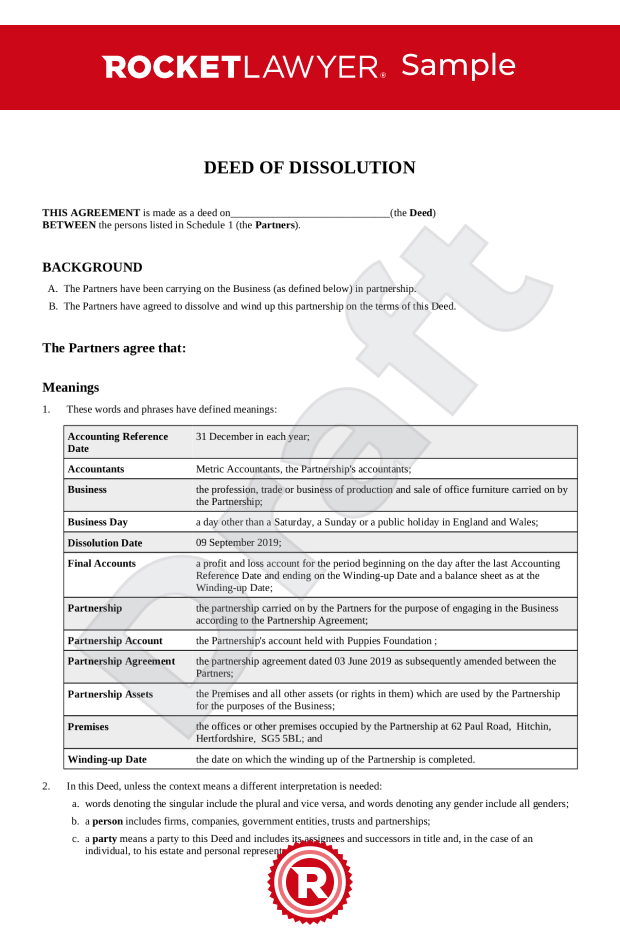

Follow proper process when you and one or more other individuals carrying on a business in partnership have agreed to bring the partnership to an end with this dissolution of partnership deed. This partnership dissolution form outlines all the important details regarding the dissolution and winding up of the company. In particular, it covers the date on which the partnership will cease trading, what the partners can and cannot do from the date of dissolution, the discharge of the partnership's liabilities, and the retention of records.

-

When should I use a dissolution of partnership deed?

Use this dissolution of partnership deed:

- when you and one or more other individuals who are carrying on a business in partnership have agreed to bring the partnership to an end

-

What's included in a dissolution of partnership deed?

This dissolution of partnership deed covers:

- the date on which the partnership will cease trading and be dissolved and how it will be wound up

- what the partners can and cannot do from the date of dissolution until the partnership is wound up

- the return of documents, the realisation of the partnership's assets and the termination of contracts and other arrangements

- the discharge of the partnership's liabilities

- the preparation and approval of the partnership's final set of accounts

- the distribution of any partnership monies after the liabilities have been discharged

- the retention of records

- the notification of the dissolution

-

Do I need a statutory declaration of name?

Although anyone can change their name at any time, in order to use a new name on official documents or have the change recognised by some government organisations, banks and even utility companies, you will usually be required to provide evidence of your change of name.

Using a statutory declaration of name change is similar to getting your name changed by a deed poll. However, unlike a deed poll, you cannot have a statutory declaration officially registered.

Aside from statutory declaration of name change and deed poll, the other way of changing your name is through marriage, civil partnership, divorce or dissolution of civil partnership.

-

What's a dissolution of partnership deed?

A dissolution of partnership deed is a document whereby business partners decide to terminate a partnership. It sets out the terms under which the partners agree to dissolve and wind-up the partnership and outlines each step of the dissolution process.

-

Do I need a dissolution of partnership deed?

A dissolution of partnership deed enables the partners to end the partnership fairly and transparently, as it determines how the business assets and liabilities will be divided between the partners.

-

What's the difference between the dissolution date and the winding up date?

The dissolution date is the date on which the partnership will cease to exist - ie the relationship between the partners terminates. After this date, the partners will complete any unfinished work, settle any liabilities, realise any partnership assets and otherwise wind up the partnership.

The winding-up date is the date when the winding-up of the partnership is completed.

-

How should the amounts held in the partnership accounts be distributed?

The amounts held in the partnership accounts should be distributed in the following order:

- for tax and debts to external lenders

- for interest on partner capital and/or loans

- for any undrawn partner profits

- for repaying partner loans

- for repaying partner capital contributions, and

- for dividing any balance between the partners

-

How should the partners share any money left in the partnership accounts after settling all outstanding payments?

When all the outstanding payments have been settled, the partners can decide to divide the balance either:

- equally

- in the same proportions as they shared profits, or

- in the same proportions to the amounts in the partner's respective accounts.

-

How long should the partnerships records be kept for?

One of the partners should be responsible for looking after the accounting records, letters and other documents for the required period of time. This deed states that the partnership records should be kept for 6 years after the date the winding up of the partnership is completed.