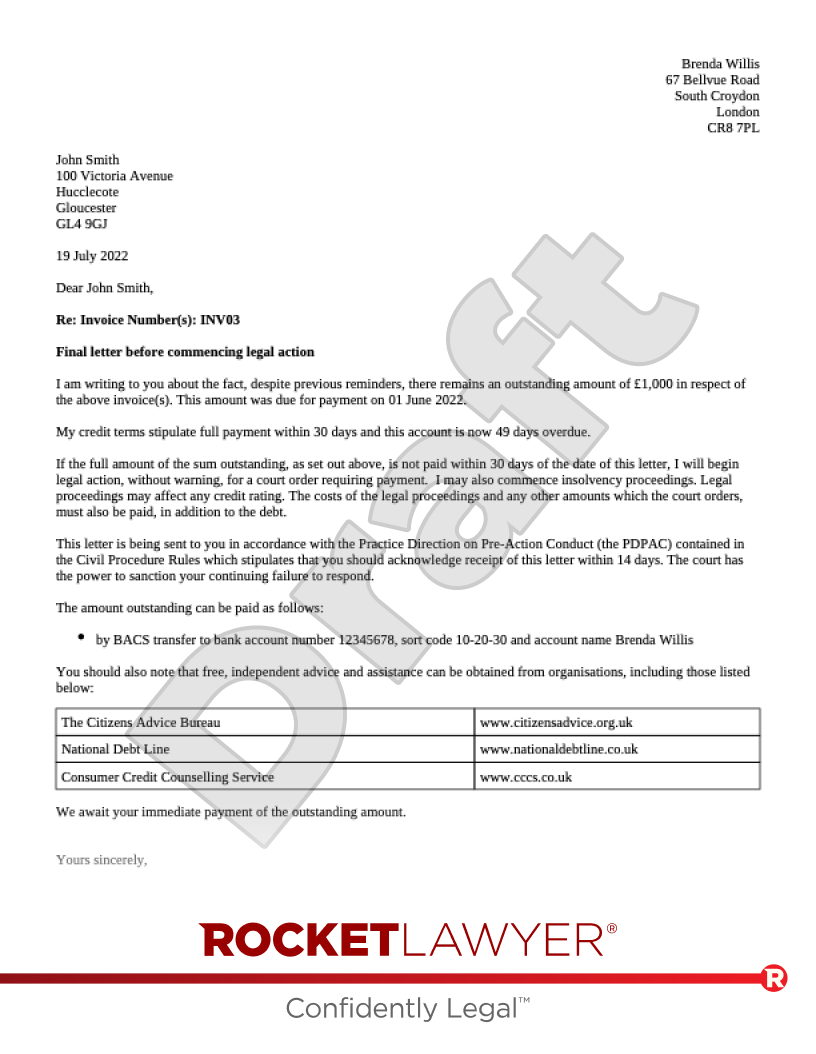

Re: Invoice Number(s):

Final letter before commencing legal action

We are writing to you about the fact, despite previous reminders, there remains an outstanding amount of £ in respect of the above invoice(s). This amount was due for payment on .

Our credit terms stipulate full payment within days and this account is now days overdue.

If the full amount of the sum outstanding, as set out above, is not paid within days of the date of this letter, we will begin legal action, without warning, for a court order requiring payment. We may also commence insolvency proceedings. Legal proceedings may affect any credit rating. The costs of the legal proceedings and any other amounts which the court orders, must also be paid, in addition to the debt.

This letter is being sent to you in accordance with the Practice Direction on Pre-Action Conduct (the PDPAC) contained in the Civil Procedure Rules which stipulates that you should acknowledge receipt of this letter within 14 days. The court has the power to sanction your continuing failure to respond.

The amount outstanding can be paid as follows:

We await your immediate payment of the outstanding amount.

Yours sincerely,