Stamp duty doesn’t need to be paid if an exemption applies or if the consideration (ie the value) given for the shares is ‘not chargeable’. Consideration is not chargeable (for the calculation of stamp duty for share transfers) when it is of a form other than cash, debt, or other securities (eg shares). For example, if shares are transferred in exchange for the issuance of a life insurance policy, this would not be chargeable consideration and stamp duty would not need to be paid.

Exemptions

If an exemption applies, stamp duty need not be paid. Some of the key exemptions are when the shares are being transferred:

-

in exchange for chargeable consideration (ie a purchase price) of £1,000 or less

-

as a gift (ie not in exchange for any money or other consideration)

-

between spouses or civil partners when marrying or entering into a civil partnership

-

on divorce or the dissolution of a civil partnership

-

while they’re held on trust and they’re being transferred between two trustees

-

following the provisions of a will or the intestacy rules

-

by a liquidator as part of the winding-up of a company

-

to a trust’s beneficiaries when a trust is being wound up

-

as certain types of loan capital

-

which are traded on a recognised growth market and not on any listed market

For more information on the exemptions, read HMRC’s stamp duty manual.

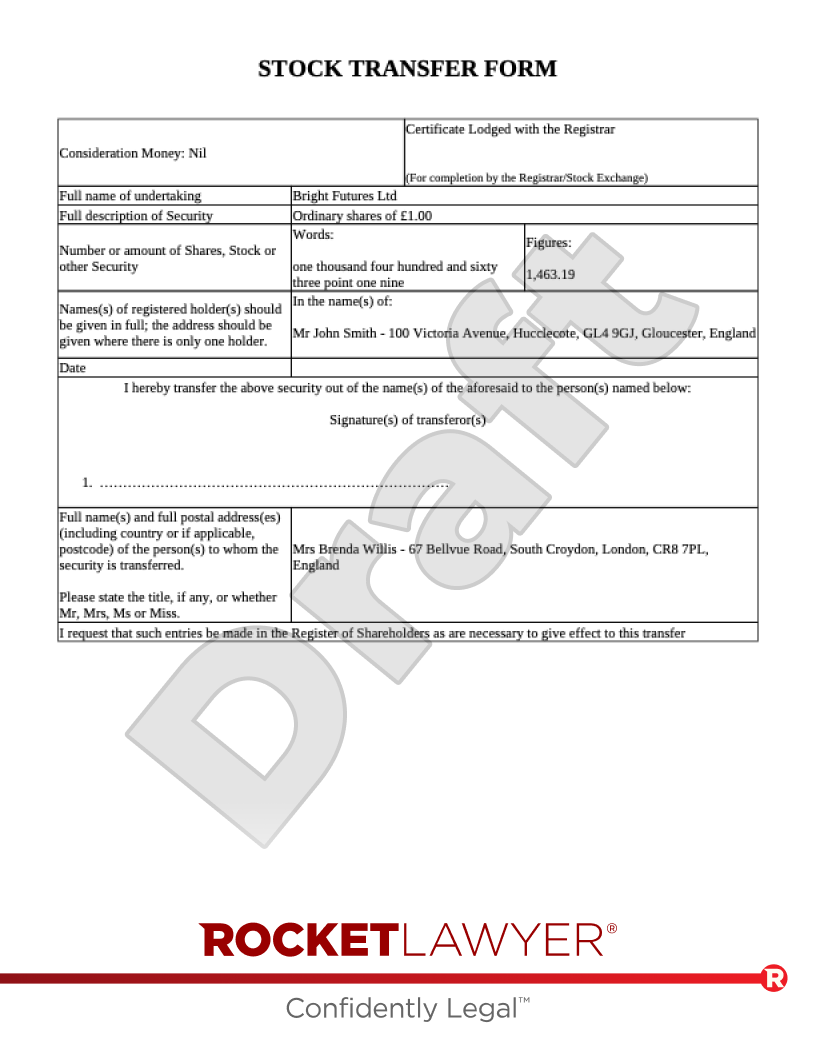

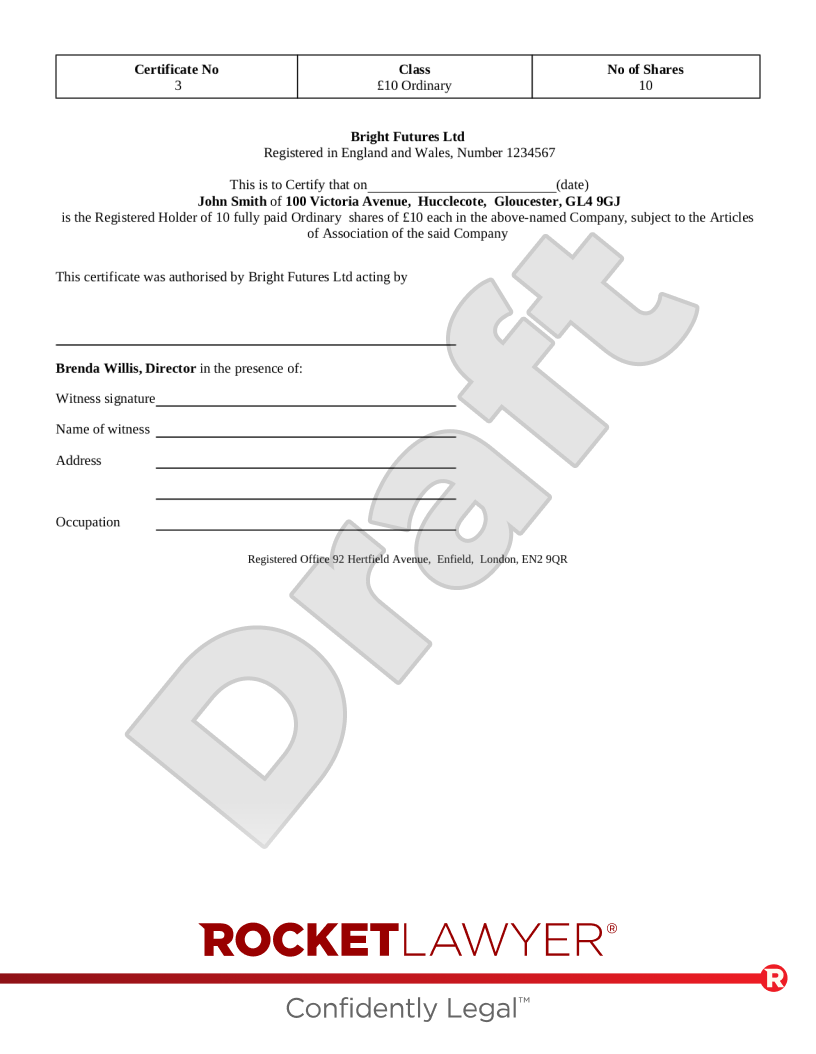

Certificates

One of the two ‘certificates’ (known as ‘Certificate 1’ and ‘Certificate 2’) attached to an STF must be filled in to attest that no stamp duty needs to be paid on the transaction. This is the case if, in exchange for the shares:

-

some but less than £1,000 chargeable consideration has been paid (and the transaction is not part of a series of transactions or a larger transaction where total chargeable consideration is more than £1,000)

-

more than £1,000 of chargeable consideration has been paid but one of the exemptions above applies, or

-

no chargeable consideration has been paid but some not-chargeable consideration has been paid

Which certificate needs to be completed depends on which of the conditions above applies. When you use Rocket Lawyer’s template to make your STF, the interview will guide you to ensure that you fill in the correct certificate. If no consideration at all has been provided in exchange for the shares, neither certificate needs to be filled in and no stamp duty needs to be paid.

Stamp duty relief

If you do have to pay stamp duty, you may qualify for a relief. A relief will reduce the amount of stamp duty you have to pay. If you’re claiming a relief you’ll need to send the completed Stock Transfer Form, together with details of the relief you’re claiming, to HMRC for them to consider the relief claim. If you’re claiming relief you don’t need to fill in either Certificate.

Reliefs are available if, for example, you’re transferring shares to a charity or to another company within the same group. For more information, read the Government’s guidance.