Declarations of Trust rely on a variety of established legal concepts. No in-depth legal understanding is required to make a Declaration of Trust Beneficial Interest, but understanding some of the key terms and ideas involved can be helpful.

Declarations of Trust set out how the beneficial (or equitable) ownership of a property will be shared. The beneficial owner (or ‘real’ owner) of something is the person who receives the benefits of owning it (eg rights to use it and to receive interest payments accumulated by it), regardless of whether they are listed as the thing’s legal owner or not. The legal owner is the person who holds the legal title to something (eg they’re listed as the legal owner at the Land Registry and/or on a property’s title deeds). If somebody has a beneficial interest in something, the thing’s legal owner will hold that thing ‘on trust’ for the beneficial owner. This means that they hold and must manage the property for the benefit of the beneficial owner. The legal and beneficial owner of something can be the same or a different person (or people).

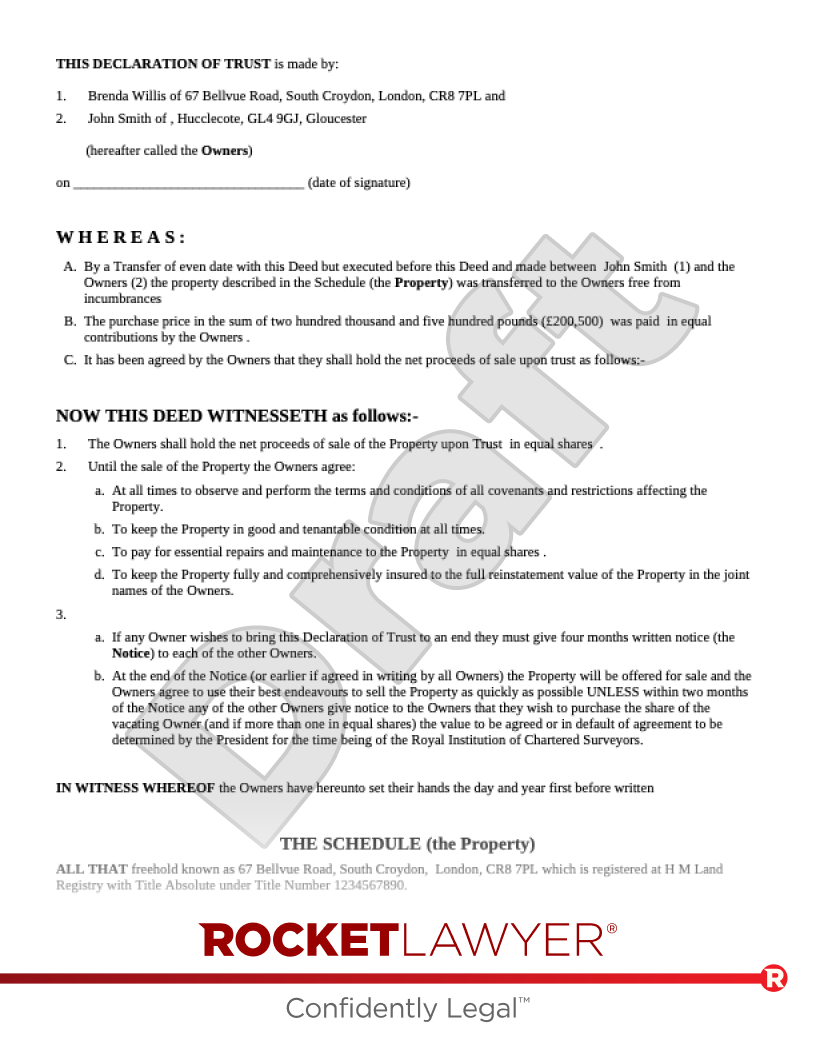

If multiple people purchase real property together (eg a house) and are registered as the owners, they will always own the legal interest as ‘joint tenants’. This means that they will always own the legal interest jointly (ie all together) and equally. The beneficial interest, however, can be held as joint tenants or as ‘tenants in common’. Tenants in common hold property in distinct shares, which can be equal or unequal. People who are not legal owners of a property may be beneficial owners of it. If you create a Declaration of Trust Beneficial Interest using this template, the owners and additional beneficiaries (ie non-legal owners) listed will all own part of the beneficial interest in the property as tenants in common. You can specify the shares in which they own it, in proportion to their contributions to the purchase price.

Note that the use of the word ‘tenant’ here has nothing to do with tenancy agreements or leases. Joint tenants and tenants in common can be the owners of a freehold property (ie when there is no tenancy/lease).

Whether a property is held as joint tenants or tenants in common also has implications for how ownership is passed on when a tenant dies.

For more information, read Co-ownership of property and Declaration of trust.