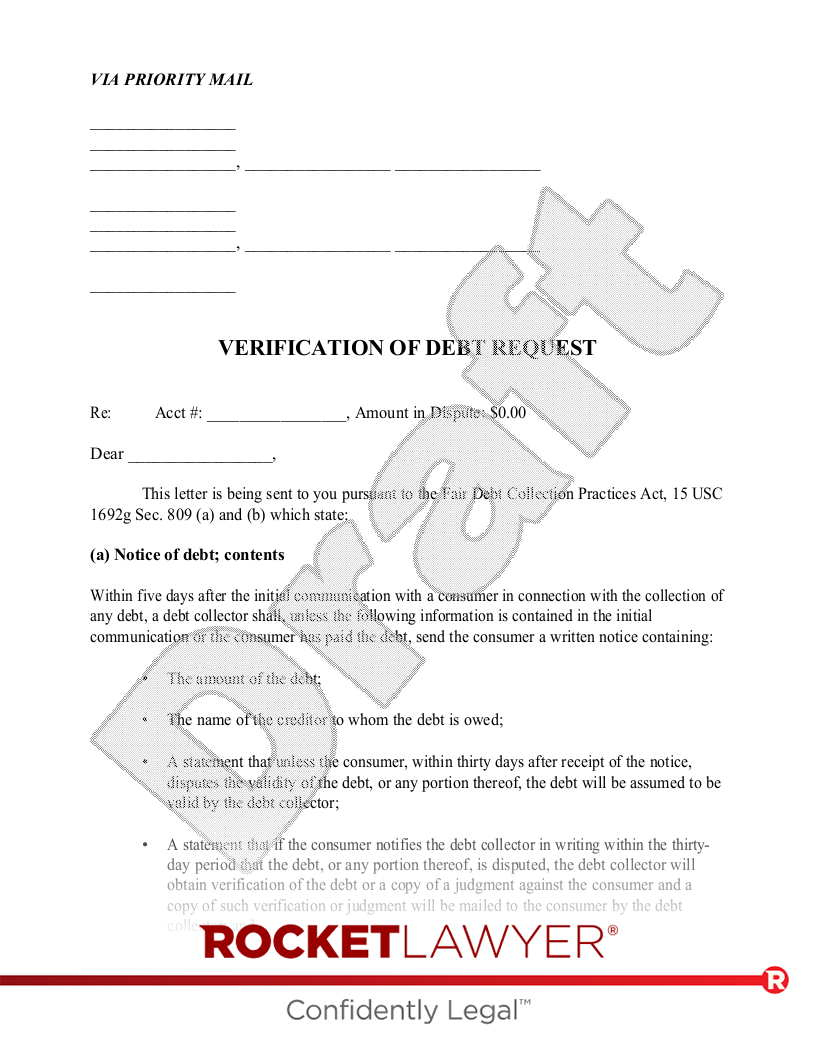

(a) Notice of debt; contents

Within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written notice containing:

• The amount of the debt;

• The name of the creditor to whom the debt is owed;

• A statement that unless the consumer, within thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector;

• A statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector; and

• A statement that, upon the consumer's written request within the thirty-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor.

(b) Disputed debts

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any disputed portion thereof, until the debt collector obtains verification of the debt or a copy of a judgment, or the name and address of the original creditor, and a copy of such verification or judgment, or name and address of the original creditor, is mailed to the consumer by the debt collector. Collection activities and communications that do not otherwise violate this subchapter may continue during the 30-day period referred to in subsection (a) unless the consumer has notified the debt collector in writing that the debt, or any portion of the debt, is disputed or that the consumer requests the name and address of the original creditor. Any collection activities and communication during the 30-day period may not overshadow or be inconsistent with the disclosure of the consumer's right to dispute the debt or request the name and address of the original creditor.

I am hereby disputing this debt and invoking my rights under the FDCPA and any other applicable state laws as well.

Request is hereby made that suspend all collection activities and that your agency provide me with clear and convincing evidence that I have a legal obligation to pay you and/or the original creditor for the amount in dispute.

Accordingly, please provide me with a complete accounting of the debt you claim I owe within thirty (30) days of your receipt of this letter. This proof must include, and is not limited to:

• The complete and signed contract for the debt obligation which is the subject matter of this dispute;

• An itemized breakdown of what you claim the money is owed for;

• Explain and show me how you calculated the amount in dispute;

• Provide me with copies of any documents, ledgers, spreadsheets, etc., that show that I agreed to pay the amount you claim that I owe;

• Identify the original creditor;

• Identify and accurately describe any third-party costs for which you are charging me, and that you have included in the disputed amount along a complete itemization of all such charges;

• Provide me with an affidavit that the Statute of Limitations has not expired on this account;

• Show me that you are licensed to collect on a debt in the ; and

• Provide me with your and your client's proof of Good Standing under the laws of and the Secretary of State along with information regarding your Registered Agent for Service of Process.

Please note: If you have reported invalidated and inaccurate information to any of the three major Credit Bureau's (Equifax, Experian or TransUnion), said action might constitute fraud and disparagement of credit under both Federal and State Laws. Accordingly, if any invalidated or inaccurate negative mark is found on any of my credit reports by you (or the third parties that you represent), demand is hereby made to remove such negative marks while this debt is being disputed.

Please respond to this request within thirty (30) days of the date of this letter. If I do not hear from you within said timeframe, then this matter will be deemed closed due to your non-compliance with the FDCPA.

Sincerely,